This article is more than

2 year oldAT&T Shed Media Assets in 2021. This Year It Wants to Add Investors.

AT&T Inc. T 0.83% faces a busy year as it tries to complete a divorce with its entertainment business, ease investor concerns about its dividend and show that it can continue to woo new wireless customers.

The Dallas conglomerate spent much of 2021 on what amounted to a gut remodel. It kicked off a series of big divestitures spanning pay TV, media production and advertising, moves aimed at refocusing AT&T on more predictable growth opportunities from profit centers such as wireless and broadband service.

Wall Street analysts broadly welcomed the changes. The stock price didn’t reflect a similar embrace by investors.

AT&T’s shares slumped 14% in 2021 and briefly touched 12-year lows in December before recovering. The selloff has pushed its dividend yield—a ratio reflecting the cash a company pays its shareholders divided by its stock price—above 8%. The S&P 500 gained 27% in 2021.

Read More (...)

Keywords

Newer articles

<p>Seven men and five women have been picked, along with the first of what is expected to be a group of six alternates. Two jurors selected earlier were dismissed, and Donald...

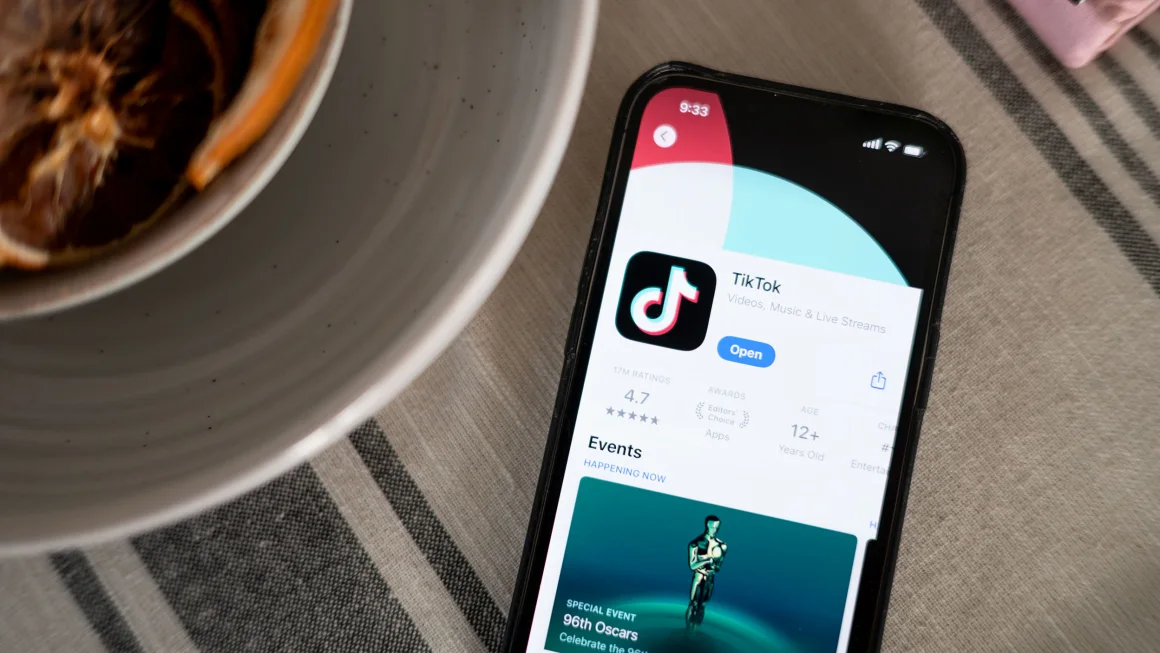

TikTok ban now ‘inevitable’

Congress gets closer to forcing TikTok to be sold or face US ban: What's ne

Israel Launches Retaliatory Strike Against Iran

Apple deletes WhatsApp, Threads from China app store on orders from Beijing

Ukraine ‘will have a chance at victory’ with new US aid, Zelenskyy says

Israel Iran attack: Damage seen at air base in Isfahan

Who will be Trump’s VP? A shortlist

‘URANIUM’: Terrifying detail about Israel’s strike on Iran emerges

US vetoes Palestinian attempt to gain statehood at the United Nations