US judge blocks JetBlue from $3.8bn Spirit Airlines takeover

A federal judge has blocked JetBlue Airways’ $3.8bn takeover of the budget carrier Spirit Airlines, agreeing with the US Department of Justice that the deal would knock competition and limit the availability of low-priced tickets.

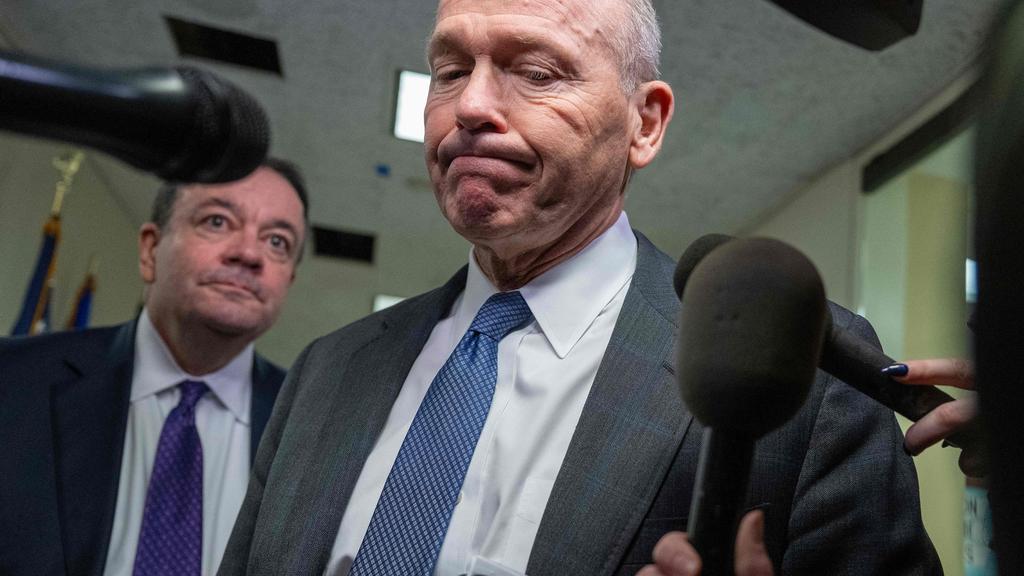

William Young, a US district judge in Boston, concluded that passengers who rely on Spirit’s cheaper fares “would likely be harmed” by the acquisition. His ruling – a victory for the Biden administration – raises questions over other planned deals in the airline sector.

Shares in Spirit halved on Tuesday afternoon. JetBlue’s stock was 6% higher in volatile trading.

In a joint statement the companies said they disagreed with the ruling and were considering their next steps. The companies could still appeal the ruling.

Young concluded that their merger “would substantially lessen competition”, siding with the justice department, along with six Democratic state attorneys general and the District of Columbia.

The proposed merger between Spirit and JetBlue “does violence to the core principle of antitrust law: to protect the United States’ markets – and its market participants –from anticompetitive harm,” the judge wrote.

He added: “Spirit is a small airline. But there are those who love it. To those dedicated customers of Spirit, this one’s for you.”

The decision has implications for Alaska Air’s $1.9bn deal to buy Hawaiian Airlines. Analysts had said that a favorable ruling in the JetBlue-Spirit case for the US justice department would make it more challenging for Alaska to close its transaction. Shares in Hawaiian and Alaska each fell by more than 3% on Tuesday.

JetBlue and Spirit said: “We disagree with the US District Court’s ruling. We continue to believe that our combination is the best opportunity to increase much needed competition and choice by bringing low fares and great service to more customers in more markets while enhancing our ability to compete with the dominant US carriers.

“JetBlue’s termination of the Northeast Alliance and commitment to significant divestitures have removed any reasonable anti-competitive concerns that the Department of Justice raised. We are reviewing the court’s decision and are evaluating our next steps as part of the legal process.”

The justice department and state attorneys general had claimed the JetBlue-Spirit deal would lead to fewer flights and higher prices for millions of Americans and “extinguish a vital source of low cost competitive disruption along more than 375 routes”, causing nearly $1bn of net harm annually to consumers.

JetBlue’s lawyers argued that the case was a “misguided” challenge to a merger between the nation’s sixth- and seventh-largest airlines, which combined control less than 8% of a domestic market dominated by four larger airlines.

Those four US carriers – United, American, Delta and Southwest – control 80% of the market following a series of previous airline mergers that the federal government blessed.

Reuters contributed reporting

Newer articles

<p data-qa="subheadline">Lawmakers sped the proposal, the most significant threat to the popular app’s U.S. operations, by tying it to a sprawling funding package offering...

Ukraine war: Kyiv uses longer-range US missiles for first time

How soon could US ban TikTok after Congress approved bill?

TikTok faces US ban as bill set to be signed by Biden

‘LOSING CREDIBILITY’: Judge explodes at Trump lawyers as case heats up

Claim rapper ‘made staff watch her have sex’

KANYE WEST PLANS TO LAUNCH 'YEEZY PORN' ... Could Be Coming Soon!!!

Megan Thee Stallion’s Ex-Makeup Guru Talks. It’s Not Pretty.

King’s Funeral Plans Dusted Off—as Health Remains a Mystery

The EU warned TikTok’s new rewards feature could be addictive. Now the app's suspended it