ESPN Boss Jimmy Pitaro’s Chaotic Race to Remake the Sports Giant

ESPN boss Jimmy Pitaro was keeping a big secret. In January, Pitaro and executives at ESPN-parent Disney DIS 1.86%increase; green up pointing triangle hosted a contingent of top NFL officials—including Commissioner Roger Goodell, and team owners Robert Kraft and Jerry Jones—at Disney’s Burbank, Calif., headquarters to discuss a potential deal.

On the table was a strategic partnership that would involve the NFL taking an equity stake in ESPN and coordinating streaming and TV efforts, said people familiar with the talks.

What the league didn’t know: Pitaro’s team at ESPN was quietly working on a totally separate deal to join forces with rival media companies on a sports-streaming service. When that venture was announced in February, the league was blindsided—and furious at being out of the loop.

As he gathered a few days later at the Super Bowl in Las Vegas with his team and a gaggle of sports celebrities, Goodell complained to one associate, “Why would Disney treat a partner this way?”

An NFL spokesman denied that Goodell made the comment.

Pitaro, who as ESPN’s chairman was an architect of the sports-streaming joint venture, got on the phone with NFL officials, telling one that the venture “will be good for the league and for fans.”

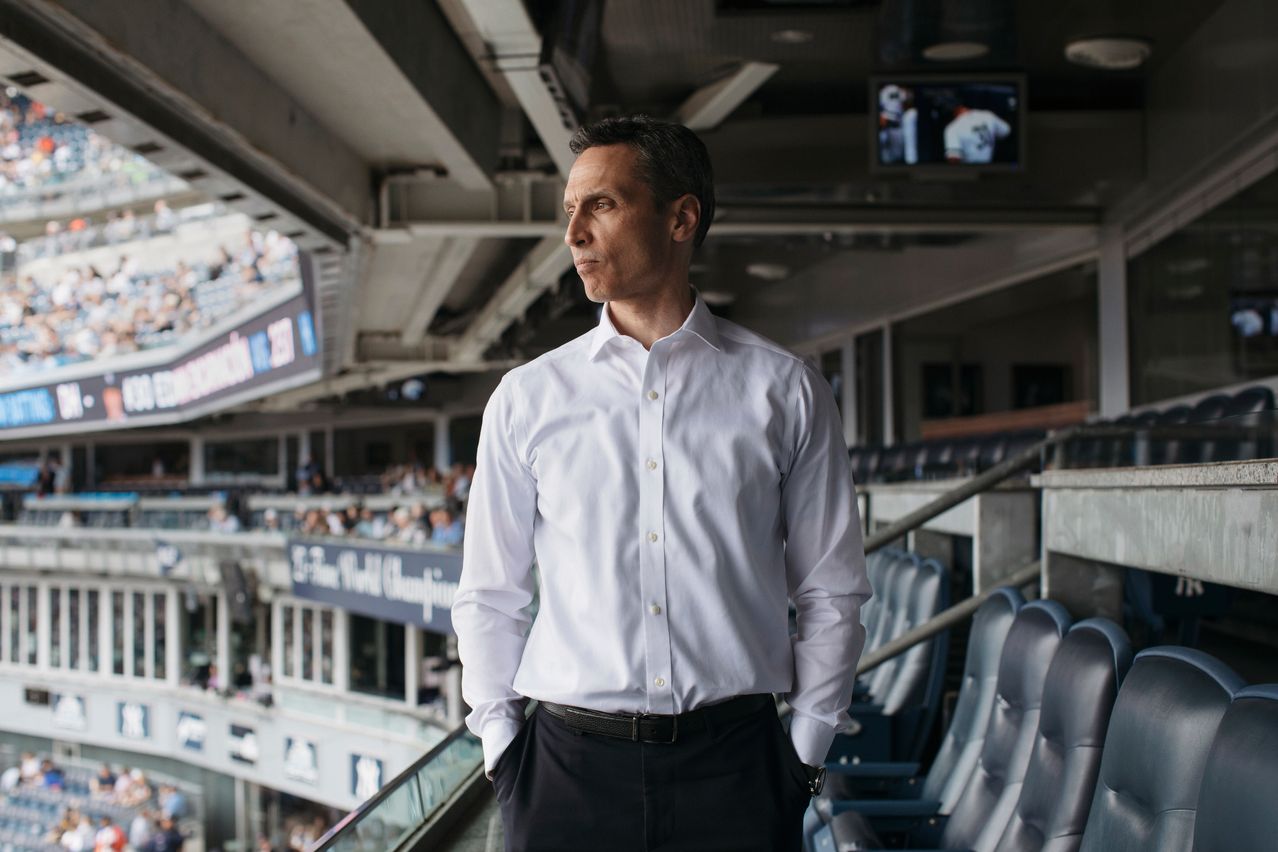

Six years into his tenure atop the world’s most storied sports-media company, the 54-year-old is racing to reinvent ESPN’s business and fend off the biggest threats it has faced in decades. That means stretching the company beyond its comfort zone.

Volatility in the media world forced Pitaro to pursue multiple streaming strategies at once, despite the risk of keeping a powerful league partner in the dark. He’s gambling that ESPN will build a big enough digital business to fill the financial hole being created as millions of Americans continue to cut the cable-TV cord.

Last year, Pitaro struck a deal to launch ESPN Bet, a gambling app that is a departure for the family-focused Disney, in a bid to draw in new audiences.

ESPN’s workplace has been volatile, too: The push for younger viewers led him to sign a huge deal with YouTube star Pat McAfee, an edgy, F-bomb-throwing host, that has backfired with some staff, leaving the impression he gives talent too much leeway.

ESPN’s cable business has shrunk to the point where it can no longer be the foundation for the future. Since 2011, the number of U.S. households paying for cable packages that include ESPN has fallen by about 29 million, reflecting a cable-TV industry collapse.

In its fiscal year ended Sept. 30—the first year Disney broke out ESPN’s financials—the division’s revenue was up 2% but profits fell 2%. In the past, ESPN had been the largest part of a media networks division whose profits steadily increased most years, making it the company’s most reliable financial engine, especially compared with the more volatile movie business.

“That’s a different environment to manage in than the previous periods of incredible growth that ESPN has experienced, right?” said Connor Schell, a former top programming executive at ESPN. “And that’s a hard job.”

Holding on to valuable live-sports rights—including ESPN’s package of NBA games—has become tougher in that financial landscape, and amid competition for those rights from new rivals such as Amazon Prime Video and Apple TV+. ESPN’s current NBA deal expires after the 2024-25 season and the network is in discussions to renew it, with an exclusive bargaining window expiring in April. Buying a smaller slate of games is one option on the table.

Pitaro is considered one of the contenders to succeed Disney CEO Bob Iger in 2026, when Iger’s contract expires and he has said he expects to step down. How Pitaro handles the next two years and the launch of the new streaming joint venture, expected in the fall, will go a long way in determining his chances.

Pitaro has earned a reputation as one of Iger’s most loyal lieutenants in a Disney career spanning 14 years. He took on top roles in interactive and consumer products before moving to ESPN.

One thing not on his résumé: experience in Hollywood, a strength held by some other contenders inside Disney.

“Do I think he’s the front-runner? No,” said an entertainment executive who has known Pitaro for years. “But you gotta at least give him a strong look.”

‘Discuss, debate, decide, align’

People who have worked with Pitaro describe him as a relentless consensus builder. His willingness to admit what he doesn’t know has won over colleagues, said Schell, the former content executive.

“I think there’s a lot of people who would’ve come into the job and been afraid to admit that maybe they had never been in a production truck before,” Schell said. “Jimmy instead turned that into a huge strength.”

Pitaro likes to toss around a management motto: “Discuss, debate, decide, align.” The idea is that, no matter how thorny the issue, everyone eventually needs to get on the same page.

Pitaro’s critics, including some former staffers and associates, said the real world is rarely as neat as that motto suggests. He needs to be more forceful to get things done and has trouble saying no, including to talent, they said. Others said Pitaro dwells too long on tough decisions, pointing to ESPN’s yearslong effort to find a partner in the sports-wagering world in order to launch the ESPN Bet app.

Pitaro’s boosters said he showed patience to find what they called the right sports-betting deal for ESPN and pointed to an array of rights deals he has struck with leagues including the NFL, NHL and MLB to retain key sports content.

They said he showed his toughness as a negotiator by walking away from a longstanding partnership with the Big Ten collegiate conference after determining the financials didn’t add up.

Pitaro grew up in Scarsdale, an affluent New York suburb, with a father who was a contractor and mother who managed a computer system in a store. He has family ties to the entertainment business: His sister is the general counsel of Major League Baseball, and his wife, Jean Louisa Kelly, is an actress whose credits include “Mr. Holland’s Opus” and “Top Gun: Maverick.”

After playing running back and wide receiver for Cornell University’s football team and getting a law degree at St. John’s University, Pitaro started his sports media career at Yahoo. He was introduced to Iger in 2010 by Sheryl Sandberg, the former Facebook executive and Disney board member, who has been friends with Pitaro for years. He joined Disney as co-president of its interactive unit, carrying out large-scale layoffs that helped the struggling division reach profitability.

An avid sports fan whose dog Jeter is named after the former New York Yankees legend, Pitaro always dreamed of running ESPN. When the top job at the network became available in late 2017, Pitaro beat out other internal contenders. “Sports have been the soundtrack of my life,” Pitaro had told Iger, he recalled in an interview with a Cornell publication.

A big part of the job is managing a cable-TV business that’s in decline but whose profits are still critical for Disney. While its growth has flattened out, ESPN still generated $2.8 billion in operating income in 2023, a big reason the entertainment giant could sustain $2.5 billion in losses in the streaming unit that includes Disney+.

ESPN’s TV ratings were up 2% in 2023 and 8% the year before, according to the company, even though the number of households that have the channel keeps declining due to cord-cutting. Quality games on “Monday Night Football” have helped, while studio shows like “First Take” and “Get Up” also posted strong gains.

Strategic partners

About a year ago, Pitaro ordered the network to lay the groundwork for a direct-to-consumer ESPN service featuring all the programming from the flagship TV channel. There were major risks. How would cable distributors who pay to carry the ESPN TV channel react? What if the plan accelerated the death of cable without replacing its riches? Pitaro batted around those issues with his team and pressed ahead.

At Iger’s behest, ESPN last summer began exploring potential strategic partners who could help advance those streaming plans. Former Disney CEO Bob Chapek had pursued similar discussions during his tenure, holding talks with companies including sports-merchandise firm Fanatics and Hollywood agency titan Endeavor, people familiar with the situation said.

Disney retained Kevin Mayer, its former head of strategy, and Tom Staggs, a former Disney CFO and parks chief, to advise on the new round of strategic talks. They brought extensive dealmaking chops and were meant to complement Pitaro.

ESPN pursued discussions with major sports leagues, including the NFL. The idea was that the NFL would offload media businesses such as its NFL Network and RedZone channels in exchange for an equity stake in ESPN. The two sides would also look to coordinate efforts in streaming, and ESPN would likely get access to more NFL games.

Initially, it looked like a long shot. By the time Goodell and the owners—Kraft of the New England Patriots and Jones of the Dallas Cowboys—were visiting Disney in January, talks had heated up.

But the NFL had no idea that Pitaro and his team were working on another streaming idea in addition to a stand-alone ESPN service.

Pitaro had begun to think there was an opportunity to give consumers an option beyond that single ESPN streaming service, which is continuing in development and will likely cost around $30 a month.

He imagined a bigger sports platform in partnership with other media companies. The idea was that while some people might only need ESPN programming, others might want to see games carried on other channels and would be willing to pay more for that.

Executives at other companies, including Fox Corp.CEO Lachlan Murdoch and Warner Bros. Discovery chief David Zaslav, had been thinking along similar lines, and before long the rivals were in deep talks.

On Feb. 6, a day before Disney reported quarterly earnings, The Wall Street Journal broke the news that the three companies were launching a joint venture to pool their sports programming and offer it in a bundle comprising 14 channels including ESPN, ABC, Fox, TNT and TBS. That service is likely to cost in the zone of $50 a month.

Pitaro called Goodell shortly before the company’s press release went out, which the NFL didn’t see as a legitimate heads up, according to people familiar with the matter. Irritating the NFL, which decides which networks carry which games and can be a major ally for ESPN in the streaming business, was risky.

Disney executives said confidentiality agreements prevented them from sharing information about the sports joint-venture with league partners.

Pitaro, who has made cultivating good relations with the NFL a priority during his tenure, sought to smooth things over in follow-up calls with Brian Rolapp, the league’s top media executive. He emphasized that the new sports venture could reach a lot of people who don’t subscribe to cable.

“The NFL’s relationship with ESPN is as strong as it has been in years and much of the credit for that goes to Jimmy’s leadership,” an NFL spokesman said in a statement.

As it continues talks with ESPN, the NFL is also exploring other strategic partnerships, a person familiar with the matter said.

How the new streaming joint venture performs will be a major piece of Pitaro’s legacy as ESPN’s top executive. If the price point is too high and it fails to win over enough consumers, ESPN will have to find new ways to establish itself in the streaming world. If the service is successful, it could reshape the sports-media landscape and improve Pitaro’s chances of winning Disney’s top job.

On Friday, ESPN said Pete Distad, a former top executive at Apple, will serve as chief executive of the new joint venture.

McAfee reprimand

As ESPN plotted a streaming strategy, Pitaro was also concerned with making the network more appealing to digital-savvy audiences, and McAfee was a big part of that plan.

ESPN signed a five-year deal worth more than $85 million to license “The Pat McAfee Show,” a daily broadcast that went on ESPN’s air in September while simulcasting on YouTube. Pitaro knew there were risks in allowing McAfee’s profanity-laced, casual-bro-chat brand of sports talk onto the network.

That became apparent in a chaotic few weeks early this year. McAfee brought NFL star Aaron Rodgers on for regular appearances, and in one telecast Rodgers made a controversial remark about comedian Jimmy Kimmel—falsely insinuating that he had ties to the late sex offender Jeffrey Epstein.

The comment threatened to land the network in hot water. Frustrated, Pitaro told McAfee that such incidents needed to be avoided, and other network officials emphasized that conspiracy theories by guests should be fact-checked in real-time, according to people familiar with their exchange.

It seemed like the issue was resolved when McAfee said on a Jan. 10 telecast that Rodgers’s regular appearances were over for the rest of the NFL season. But the next day, Rodgers was back on the show.

McAfee had told Pitaro that he intended to bring back Rodgers for major breaking news, and the exit of Bill Belichick as the Patriots’ head coach met that threshold, so he invited Rodgers back.

But events in 2020, especially the national racial and social justice reckoning after the murder of George Floyd at the hands of police, changed the equation. “It was unavoidable that we were gonna find ourselves veering beyond the world of sports,” said Stephen A. Smith, ESPN’s biggest star and the host and executive producer of “First Take.”

Elle Duncan, an anchor on the flagship studio show SportsCenter who has spoken publicly about abortion and LGBTQ rights, said Pitaro is supportive of her view that these are moral and human-rights issues. “They’re not political issues. They have nothing to do with red versus blue,” she said.

Smith gets a lot of freedom. When he sought permission to host a podcast that is unaffiliated with ESPN, Pitaro felt keeping Smith happy was worth the risk that he might say something that would reflect poorly on the network and allowed it.

In January, as Smith prepared to tape a podcast episode, he alerted Pitaro and other Disney executives that “they were not going to recognize the person that they heard,” Smith said in an interview.

He then went on the show and launched into a rant against Jason Whitlock, a former ESPN employee who, like Smith, is a prominent Black sports commentator. Smith said Whitlock, who had questioned the veracity of his memoir, was worse than white supremacists and called him the “worst, most despicable, lying, no-good, fat-ass human being I have ever known in my life.”

The tirade went viral and wasn’t well received in ESPN’s headquarters. Whitlock responded, calling Smith a “fraud” and “pathological liar.”

As for Pitaro, Smith said, “We haven’t spoken about it, but I’m quite sure he wasn’t happy about it.”

Write to Isabella Simonetti at isabella.simonetti@wsj.com and Robbie Whelan at robbie.whelan@wsj.com

Corrections & Amplifications

ESPN officials conveyed to host Pat McAfee that conspiracy theories by guests should be fact-checked in real-time, following an incident involving Aaron Rodgers. An earlier version of this article incorrectly said Jimmy Pitaro had directly given McAfee that guidance. (Corrected on March 18. )

Keywords

<p>Chinese officials say they "firmly oppose" the platform being divested.</p>

Ukraine ‘will have a chance at victory’ with new US aid, Zelenskyy says

Congress passes bill that could ban TikTok after years of false starts

Ukraine war: Kyiv uses longer-range US missiles for first time

How soon could US ban TikTok after Congress approved bill?

TikTok faces US ban as bill set to be signed by Biden

‘LOSING CREDIBILITY’: Judge explodes at Trump lawyers as case heats up

Claim rapper ‘made staff watch her have sex’

KANYE WEST PLANS TO LAUNCH 'YEEZY PORN' ... Could Be Coming Soon!!!

Trump lawyer tells SCOTUS that president could have immunity after ordering military to assassinate a political rival