Capital One Is Buying Discover Financial

Capital One said it will buy Discover Financial Services DFS -0.21%decrease; red down pointing triangle for more than $35 billion, a deal that will marry two of the largest credit-card companies in the U.S.

Under the terms of the all-stock deal, Discover shareholders are set to receive 1.0192 Capital One shares for each Discover share, representing a premium of about 27% based on Discover’s closing price Friday. After the deal closes, Capital One shareholders will hold roughly 60% of the combined company, with Discover shareholders owning the rest.

Capital One is making a big bet at a booming time in the credit-card sector. More consumers are moving from paying with cash to cards as a result of generous rewards programs and the digitization of commerce—a transition that accelerated with the pandemic. A recent increase in credit-card debt has provided a further boost to issuers.

Credit-card debt hit a record high in 2022, due in part to rising prices and declining savings. WSJ’s Dion Rabouin explains why U.S. consumers are starting to fall behind on payments and what it could mean for the economy. Illustration: Elizabeth Smelov

Buying Discover would give Capital One, a credit-card lender with a market value of a little over $52 billion, a network that would vastly increase its power in the payments ecosystem.

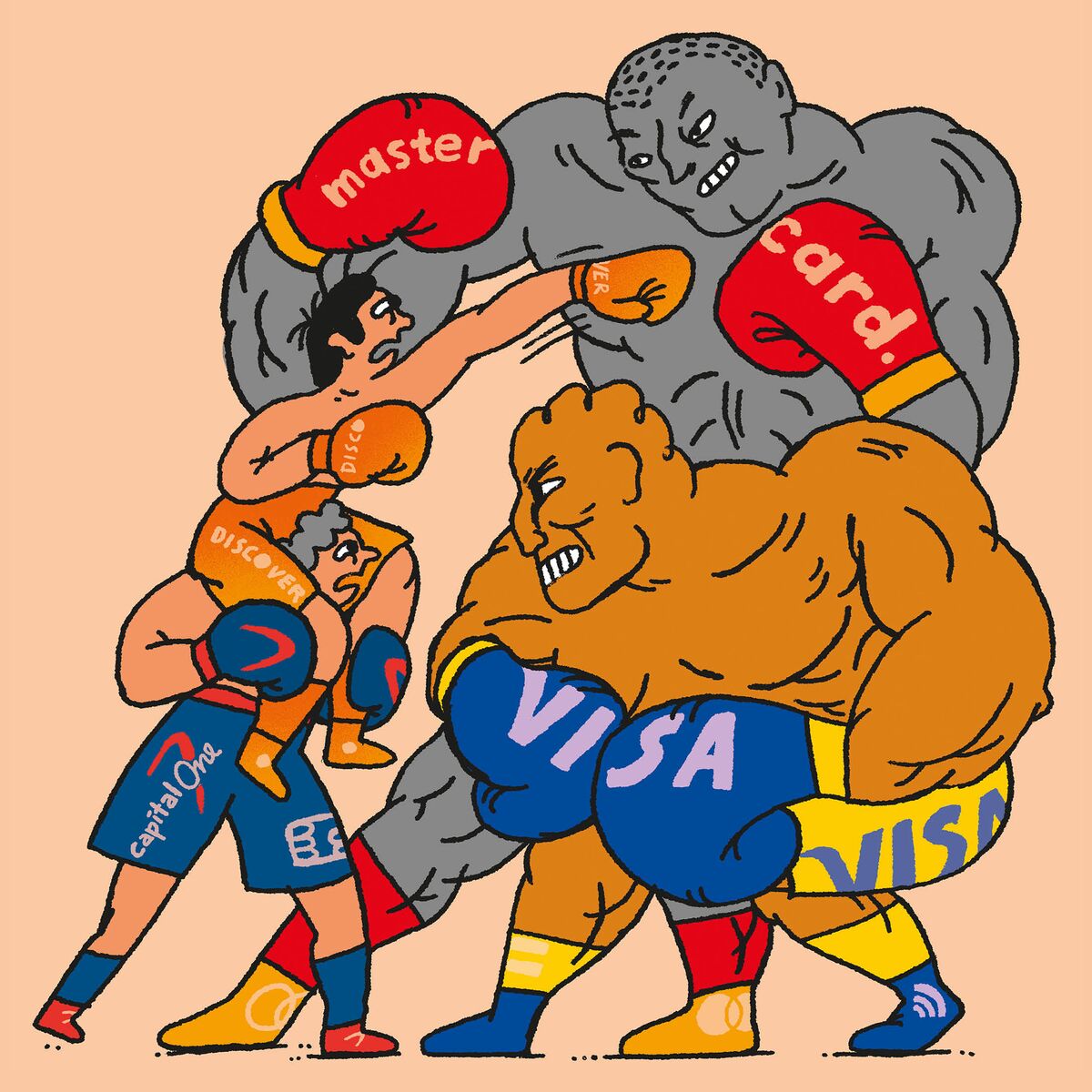

Card networks are critical to enabling transactions and setting fees that merchants pay when consumers shop with credit cards. Though much smaller than Visa and Mastercard, Discover is one of the few competitors to those companies in the U.S. and it is one of a small number of card issuers that also has a payments network.

Capital One, the ninth-largest bank in the country and a major credit-card issuer, uses Visa and Mastercard for most of its cards. The bank plans to switch at least some of its cards to the Discover network, while continuing to use Visa and Mastercard on others. Those larger networks have more merchant acceptance abroad than Discover does.

Capital One also plans to maintain the Discover brand on the cards and network—assuming regulators sign off and the deal is consummated.

Discover, based in Riverwoods, Ill., is an online institution so the takeover wouldn’t come with physical bank branches, except for one location in Delaware.

The deal follows a tumultuous period for Discover that has included increased regulatory scrutiny and a change in leadership.

The company disclosed last year that an internal review found it had misclassified certain credit-card accounts beginning in 2007, incorrectly placing them in the highest merchant-and-acquirer pricing tier. The company established a liability of $365 million to account for estimated compensation owed to merchants and acquirers.

Separately, Discover received a consent order from the Federal Deposit Insurance Corp. In October, Discover said it would address the FDIC order to improve its consumer-compliance operations.

In December, Discover said financial-industry executive Michael Rhodes would become its CEO and president. He took over from John Owen, who had been serving in the interim after Roger Hochschild stepped down in August.

Discover has been approached by large banks and technology companies about an acquisition of all or a part of its business over the past decade or more. Tech companies have been interested in acquiring its network so that they can play a more central role in payments, but prior senior executives at Discover weren’t interested in separating the company’s credit-card lending side from the network.

For Capital One, the deal would also further expand the number of cardholders it will count as customers for its credit-card lending business. Many Discover cardholders have high credit scores.

Discover also has consumer deposits, most of which are in savings accounts, allowing Capital One to continue to grow its already large presence in that area.

For roughly a decade now, big U.S. banks have aggressively competed for customers by rolling out new credit cards or enhancing their existing ones with more cash-back offers or points programs that dangle the possibility of free or discounted airfare, hotel stays or other travel perks.

Credit-card debt fell during the pandemic but is rising again. That translates into lucrative interest charges that cardholders pay to the banks that issue their credit cards.

Issuers face the risk of rising delinquencies and loan losses, however, if unemployment rises or a recession kicks in.

Rising credit-card usage is also a boon to the billions of dollars in interchange fees banks collect every year. The fees are set by card networks and paid by merchants when consumers shop with cards. By owning the Discover network, Capital One would be able to negotiate interchange fees and other terms directly with merchants for card transactions that travel over its network, making Capital One more of a competitor to Visa and Mastercard.

An acquisition of Discover will rank among the biggest deals so far in 2024. After a lull in M&A activity in 2023 as economic and other uncertainty and increased interest rates took a bite out of the appetite for deals, volumes have gotten off to a relatively strong start and are up 90% in the U.S. compared with a year earlier, according to Dealogic. Other big transactions include software maker Synopsys’ roughly $35 billion acquisition of rival Ansys and Diamondback Energy’s $25 billion deal for Endeavor Energy.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and Lauren Thomas at lauren.thomas@wsj.com

Corrections & Amplifications

Bloomberg reported earlier Monday that Capital One was weighing a deal for Discover. An earlier version of this article incorrectly said the report was on Sunday. (Corrected on Feb. 19)

Appeared in the February 20, 2024, print edition as 'Capital One Gets Discover For $35 Billion

Keywords

Newer articles

<p>A bill that will ban TikTok in the United States unless its Chinese owner divests from the company has passed overwhelmingly.</p>

Congress gets closer to forcing TikTok to be sold or face US ban: What's ne

Israel Iran attack: Damage seen at air base in Isfahan

Ukraine ‘will have a chance at victory’ with new US aid, Zelenskyy says

Who will be Trump’s VP? A shortlist

Ukraine war: Kyiv uses longer-range US missiles for first time

House passes potential TikTok ban that could speed through Senate

How soon could US ban TikTok after Congress approved bill?

Congress passes bill that could ban TikTok after years of false starts

Taylor Swift broke Spotify record with new album